As inflation hits a 30-year high and prices continue to rise, the Bank of England is predicting the biggest financial squeeze in over 30 years. And with National Insurance rates and the energy price cap increasing from next month, financial uncertainty looks set to trouble many households throughout the year.

According to our latest research, 50% of people across the UK say things are ‘really difficult’ financially at the moment and 54% feel they’d struggle to deal with an unexpected bill. And with inflation predicted to rise further in the spring, this on-going worry presents a real mental health concern as people try to keep up with rising costs.

While it can be tricky to navigate conversations around money in the workplace, people will be looking to their employer to take action to support them through this period. Whether it’s an inflation-linked pay rise, additional workplace benefits or signposting to external support, there will be a growing expectation for employers to take a proactive approach to money and mental health.

How can employers help with financial wellbeing?

Employers may be hesitant to broach the topic of personal finance with their people. Our relationship with money can be complex and the conversation is often difficult, especially in the workplace.

But money worries are a wellbeing concern as much as a financial one, and employers must consider the stress and mental health impact of a workforce feeling the squeeze.

With almost three-quarters of the population (73%) worried about the increased cost of living, managers should be prepared to discuss financial wellbeing concerns with their team.

While some employees may approach this conversation with expectations around pay and benefits, many more will value the opportunity to discuss their problems and feel heard, and managers should feel confident to ask what they can do to help. This might be as simple as signposting information and resources for those who need further guidance.

HR teams should consider what aspects of their existing benefits package could be helpful to those under financial stress. Employees may not fully understand how to claim their workplace benefits, so it’s important to communicate what’s on offer on a regular basis. You could hold a webinar or workshop to remind employees about any salary sacrifice schemes, pension options, retail discount schemes or training opportunities which may help them to manage their personal finances.

Signposting your people to further advice

As an employer, it’s often not possible to offer financial advice, but you can share a list of useful resources via email or your intranet to ensure employees have access to professional support. Try to include a variety of different services such as:

Mind.org.uk

Information from popular mental health charity Mind, exploring the link between money and mental health.

Citizens Advice

Tailored help and advice with understanding debt and money.

NHS — Coping with financial worries

Practical advice to help people better manage financial stress and its impact on their health.

Stepchange

Expert debt advice and fee-free debt management for those who are struggling to repay.

Read more about workplace mental health

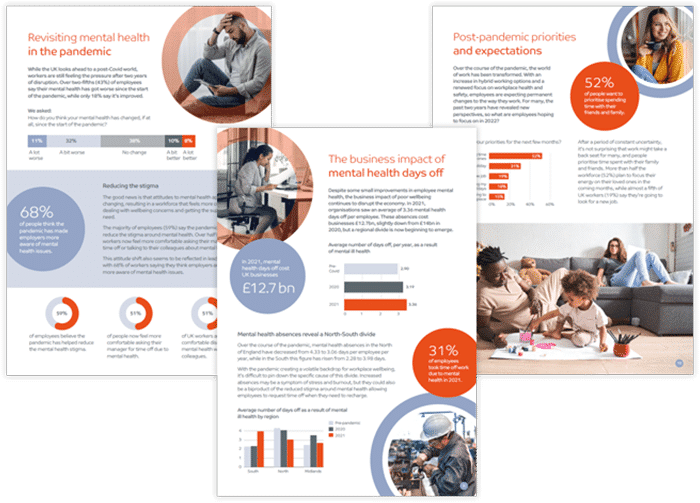

This blog is an extract from our latest report, Our Changing Attitudes to Mental Health, which explores how people feel about the most pressing employee wellbeing issues in light of the Covid-19 pandemic.

Download the free 12-page report to find out how the past two years have impacted mental health in the workplace and what support people are seeking from their employer.